OTC Arbitrage - Crypto’s Best Kept Yield Secret

Neutrl is unlocking access to OTC arbitrage, a historically inaccessible source of stable, market-neutral yield. This article outlines how the strategy works, why it matters, and how Neutrl makes it available onchain through structured execution and transparent risk management.

OTC arbitrage is one of the most consistent and scalable sources of market-neutral yield in crypto. It plays a central role in Neutrl’s strategy, offering structured returns that are independent of market direction.

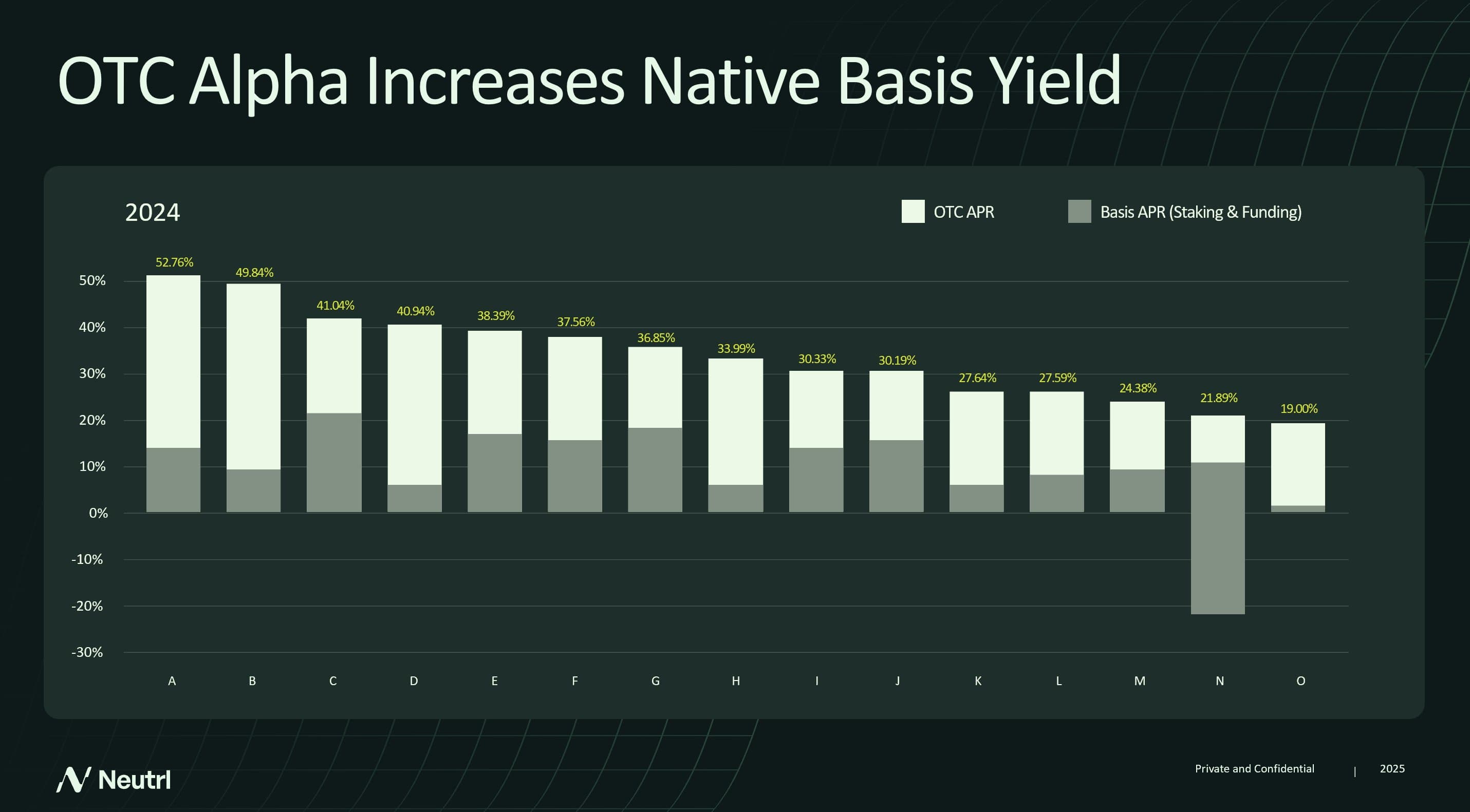

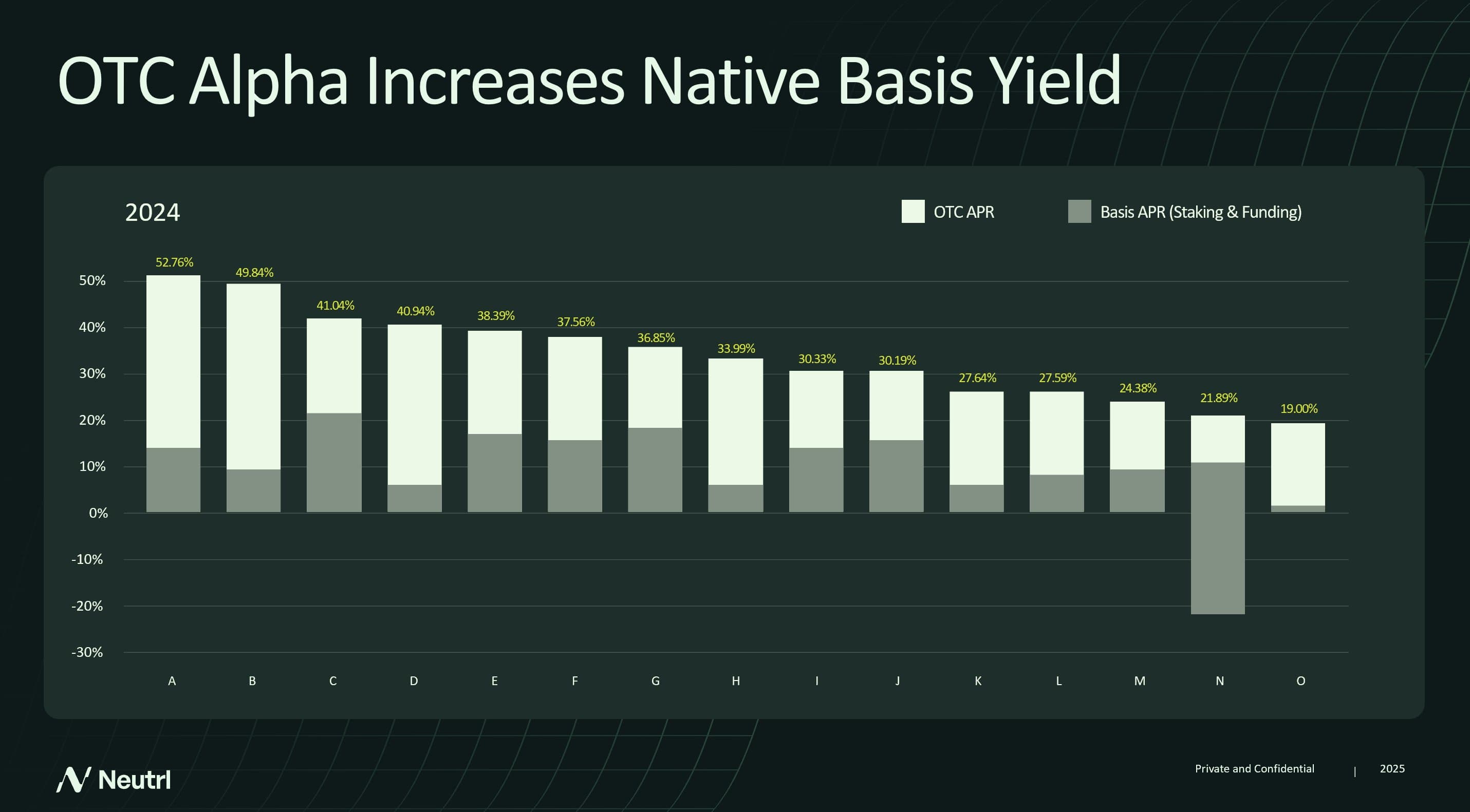

By combining OTC arbitrage with basis yield, Neutrl unlocks annualised returns in the range of 30 to 50% APR, even during volatile or low-liquidity market conditions.

Neutrl earns yield by sourcing tokens OTC at a discount and immediately hedging the exposure using perpetual futures. This locks in a fixed, market-neutral return for holders of sNUSD. There are no directional bets. No dependency on emissions or borrowing demand. Just execution-based yield.

The protocol sources OTC tokens and SAFTs directly from foundations and early investors who are seeking structured liquidity. This is not a negative signal. Foundations often sell to extend runway, fund hiring, or finance ecosystem development. Early investors typically recycle capital back into the broader crypto economy.

Once the discounted assets are secured, Neutrl opens short perpetual positions to hedge the price exposure. This is not discretionary hedging. It is systematic, designed to ensure the discount is captured as fixed return regardless of price movement or unlock timeline.

These OTC deals are often inaccessible to the public. They are negotiated privately and typically allocated to large crypto funds, market makers, or high-net-worth individuals.

Neutrl unlocks them by pooling capital from the community. The protocol acts as an execution layer, enabling users to participate in structured yield strategies that would otherwise remain out of reach.

Basis arbitrage is the oldest delta-neutral trade in crypto. It involves capturing funding rate dislocations between spot and perpetual futures markets. It is liquid but variable, depending on market structure and funding conditions.

OTC arbitrage is less liquid, but often produces higher and more stable returns. The yield is driven by token discounts, not by funding volatility. Neutrl combines both strategies in a blended yield model. Basis arbitrage provides liquidity and flexibility, while OTC arbitrage delivers fixed, higher-margin returns over longer durations.

Neutrl accesses OTC deal flow through a mix of industry relationships, direct outreach to token foundations and early investors, and trusted OTC brokers supported by institutional custody partners.

The protocol’s advantage lies in its ability to consistently source high-quality opportunities, apply rigorous due diligence, and execute with a level of risk management typically reserved for professional trading firms. In a market where poor execution can significantly reduce returns, Neutrl prioritises precision, consistency, and operational discipline across every stage of the process.

Neutrl’s risk framework is foundational to its strategy and execution. Counterparty risk is managed through smart contract vesting or institutional-grade escrow with providers such as BitGo, Anchorage, and CEFFU, ensuring every deal includes clearly defined settlement mechanics. Exchange risk is mitigated using off-exchange settlement (OES), which keeps assets secured and minimises exposure to centralised venues. Liquidity risk is addressed by maintaining capital buffers sourced from liquid basis arbitrage positions and stable collateral pools. Hedging risk is controlled through perpetual liquidity analysis, careful position sizing, and automated execution systems.

Neutrl does not rely on informal agreements. There are no handshakes. Every transaction is secured either onchain or under enforceable contractual terms.

A common misconception is that shorting a token after acquiring it OTC is inherently bearish or predatory. This is not the case. Neutrl hedges to neutralise price exposure, not to speculate on downside.

Neutrl’s goal is to preserve yield, manage volatility, and ensure that unlock events unfold with minimal market disruption. In practice, most token unlocks are followed by immediate sell pressure. By hedging these positions, Neutrl helps smooth the distribution process and mitigate sharp price movements, creating a more stable and predictable environment for all participants.

Neutrl’s hedging approach delivers clear benefits to the broader market by reducing sudden spot selling into thin liquidity and helping to maintain balanced perpetual funding rates across venues. It increases open interest and deepens perp liquidity, creating more favourable conditions for long-side participants.

These effects contribute to healthier price discovery, reduced volatility, and a more resilient market structure, particularly during token unlock events. Both investors and token projects benefit from this added stability and predictability.

For project teams, working with a hedged OTC participant like Neutrl offers several key advantages. Token flows are predictable and structured, reducing uncertainty around liquidity events. Volatility during unlock periods is minimised through systematic hedging, which protects both the protocol and the market.

Most importantly, Neutrl provides long-term alignment as a professional counterparty. It does not flip tokens for short-term gain. Instead, it manages exposure responsibly, preserves value, and operates with full transparency.

For users, Neutrl offers access to high-quality OTC opportunities paired with risk-managed, delta-neutral execution. The result is a stable, uncorrelated yield stream backed by real trading activity rather than speculative narratives or inflationary incentives. This is real yield, generated through structured deals, professional risk controls, and full onchain transparency. It is designed to be sustainable, measurable, and resilient across market conditions.

Neutrl continues to build the infrastructure for sustainable, market-neutral yield in crypto. With the dApp in development and expanded dashboards, documentation, and strategy breakdowns on the way, the focus remains clear: unlock institutional-grade yield through structured execution, transparent risk management, and composable onchain access.

gNeutrl.