How Neutrl Values OTC Deals And Why It Makes Our Reserves Safer

At Neutrl, safety and transparency are core to the protocol. We use industry best practices, and mark our OTC positions the way real risk managers at large institutional funds do: conservatively, consistently, and with a liquidation-focused mindset.

Today we dive into exactly how we value OTC positions on the Neutrl Transparency Dashboard, why the method is intentionally conservative, and how it protects depositors through market cycles. Our aim is simple: give you the clarity to deposit with confidence and to understand how your capital stays safe.

The Neutrl portfolio is composed of:

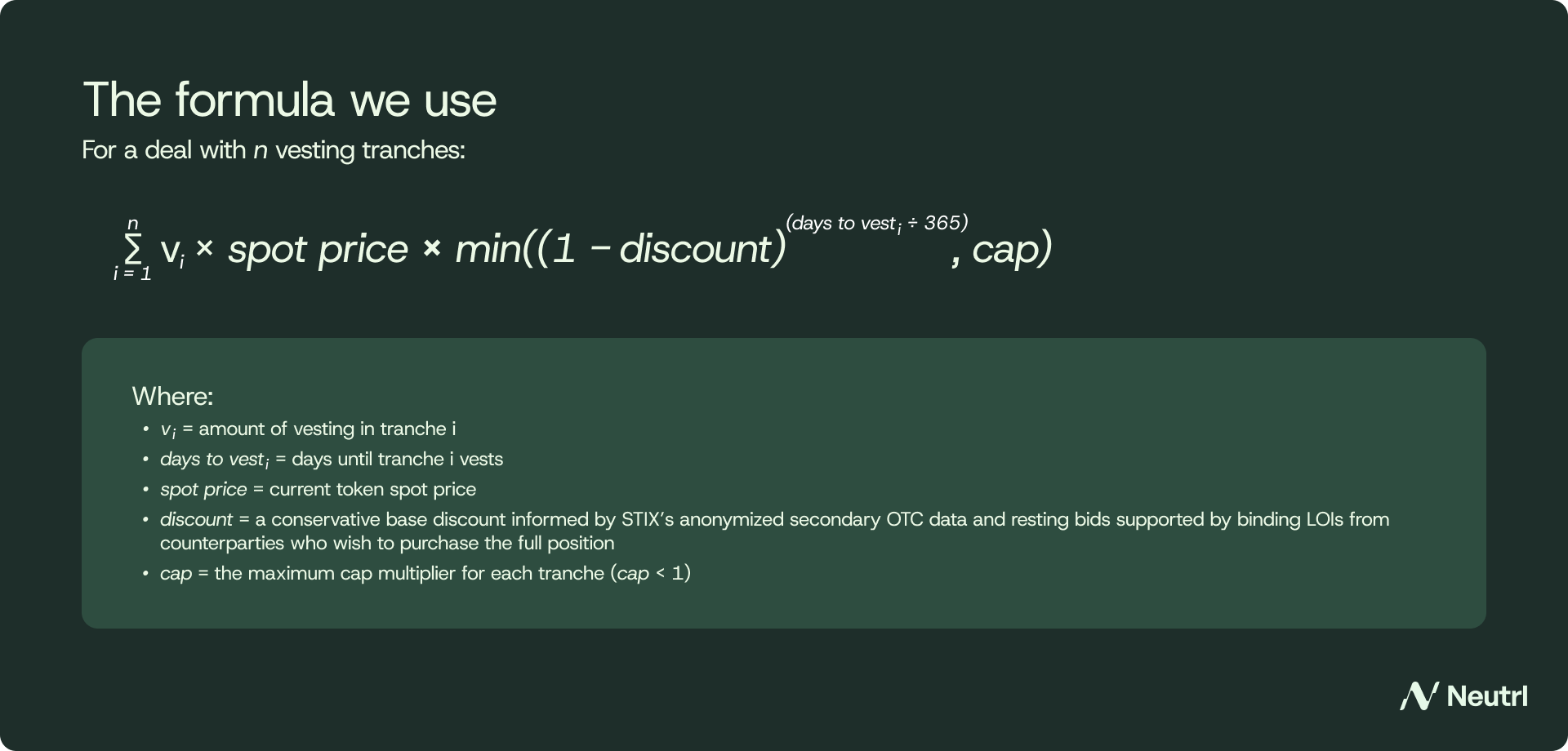

Our reserves aim to state the current market value of our portfolio. Locked tokens are by nature, illiquid, so instead of marking the position at current prices, we mark OTC positions at a conservative worst-case liquidation price today, not a hopeful price tomorrow. This is the same way that institutional asset managers account for illiquid positions in Traditional Finance. Our methodology applies a time-weighted “illiquidity” discount to each vesting tranche, with a cap on the value of any tranche. This captures the cost of illiquidity, sale frictions, and execution risk if we had to liquidate quickly.

Our approach mirrors how institutional investment managers value hard-to-trade or restricted assets. The key principles are simple:

In practice, leading firms use time-based discounts for illiquidity and report hedged net exposure to avoid overstating value. Neutrl follows this discipline and goes further with an explicit cap near vest, and conservatively sourced discount inputs. This ensures that depositor safety wins over optimistic valuation.

This formula is intentionally conservative:

We partner with Accountable to provide ZK-proof verification of reserves. Accountable connects directly to our exchange accounts via read-only APIs to attest to balances, margin, and hedge positions, and it independently verifies our OTC deal valuations using the methodology described above. The system generates zero-knowledge proofs that confirm portfolio totals and constraint checks (e.g., assets ≥ liabilities, hedge coverage, OTC discounting and caps applied) without revealing token-level positions or venue identifiers. This gives you cryptographic assurance that the numbers on our Transparency Dashboard are complete and accurate, while preserving the privacy needed to protect the protocol from stop hunting or other predatory behavior.

Neutrl’s OTC valuation is simple but elegant: time-weighted discounts, a hard cap for realism, and a hedge-aware presentation. It’s conservative enough to protect deposits, rigorous enough to stand up to institutional scrutiny, and clear enough for anyone to follow on our dashboard.

This balance of safety, clarity, and discipline represents the level of transparency DeFi deserves and reinforces Neutrl’s position as a leader in transparency for synthetic dollars.

Learn more about Neutrl by reading our docs, and follow us on X for more updates.