Neutrl’s Delta-Neutral Yield Leads in All Market Conditions

As DeFi yields compress, Neutrl’s delta-neutral strategy delivers ~30% APY by combining OTC arbitrage, liquid basis and staking, sustaining returns in all market conditions.

TLDR:

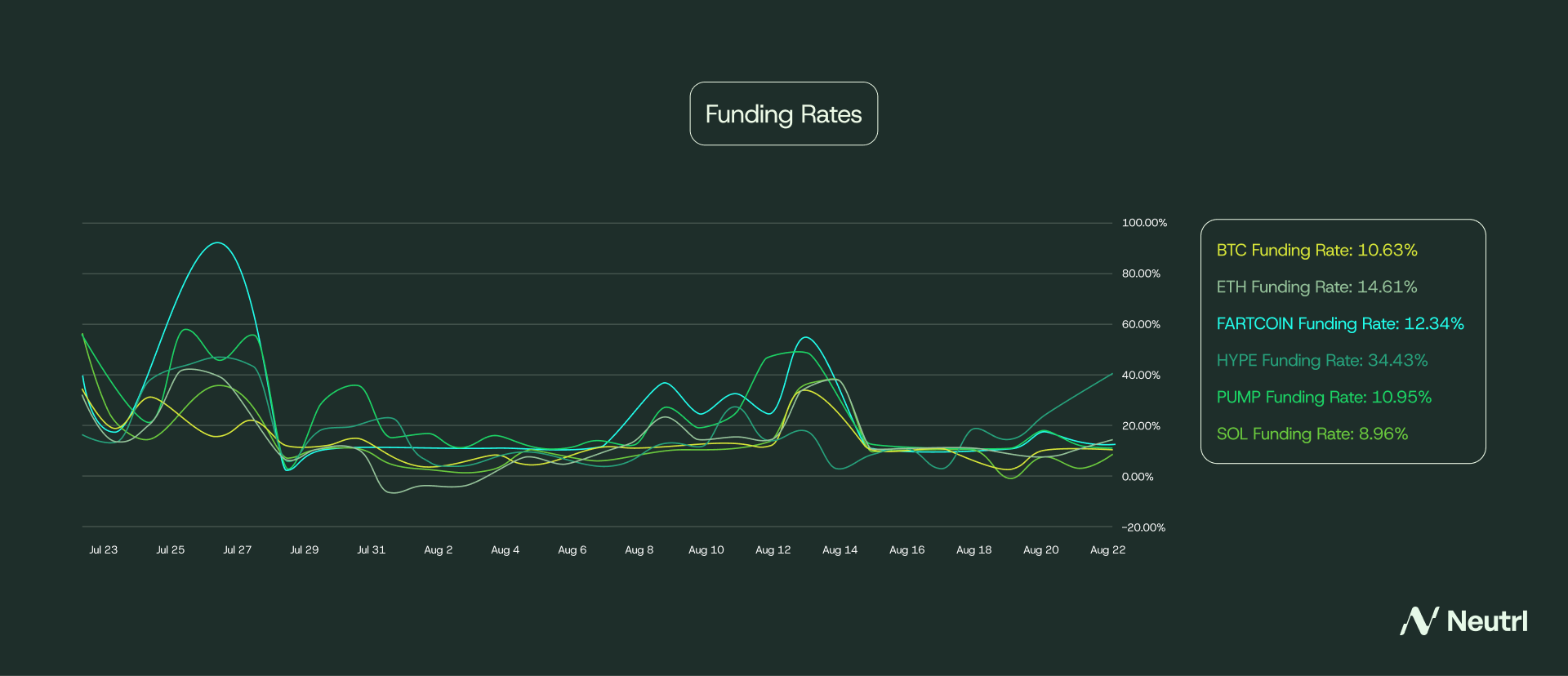

Yields across DeFi have compressed hard over the past month. Spark’s USDS farm rate is down from 8% to 6.5% today; sUSDe has slipped from 16% to 7.5%, HLP is now 8%. Even liquid basis funding rates on Hyperliquid have reset dramatically over the last month - Fartcoin leverage liquid basis (a delta neutral fund favourite over the past few months) which was at 90% APR is now mid teens.

Neutrl’s trading yield is not reliant on market conditions.

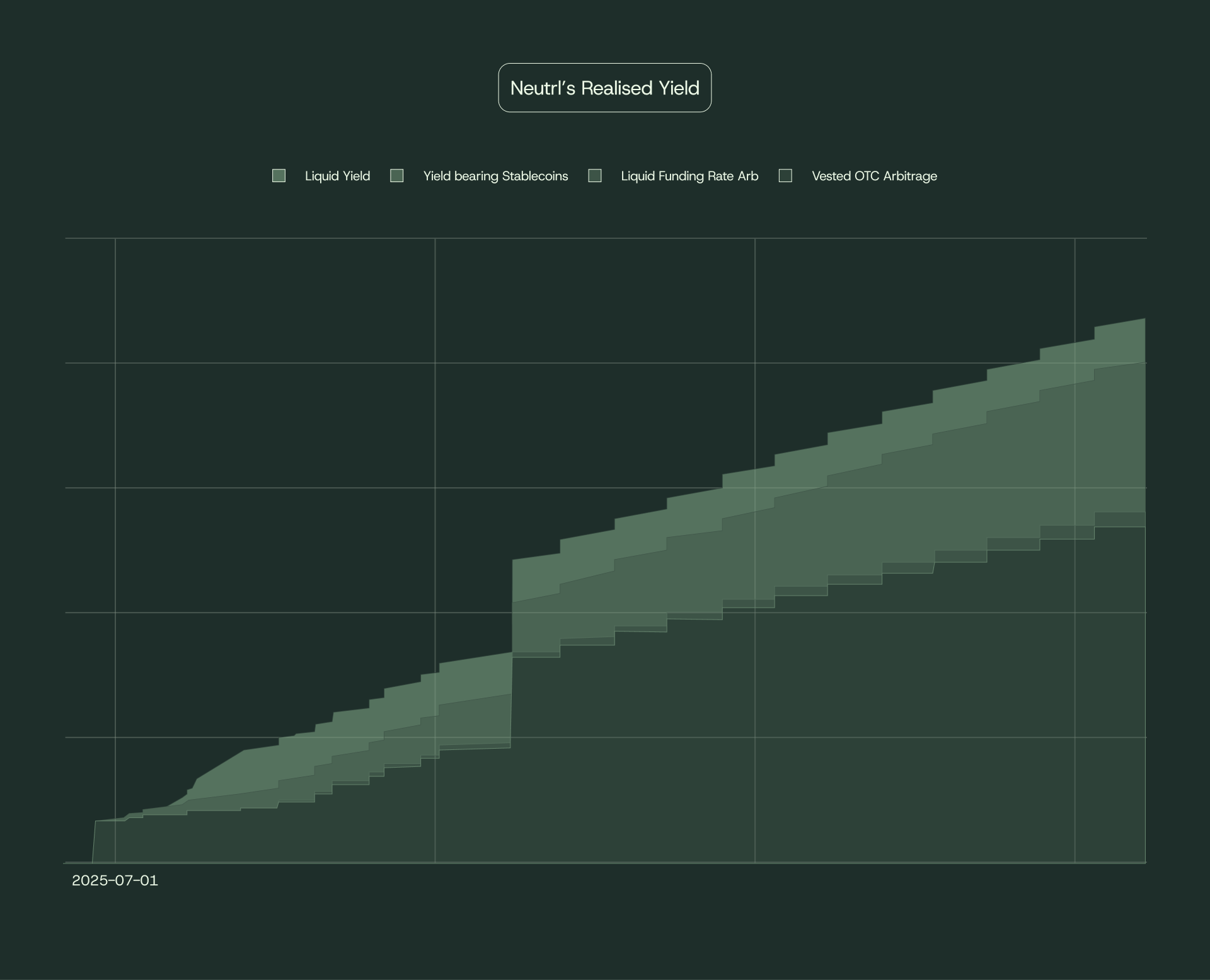

OTC arbitrage is the largest driver of Neutrl’s yield, providing stability even when funding rates weaken.

OTC arbitrage is the largest driver of Neutrl’s yield, providing stability even when funding rates weaken.

OTC arbitrage profits under all funding rate market conditions. When funding rates are high this is an additional, reliable yield source for Neutrl, boosting returns by capturing profitable perpetual funding across a wider range of altcoin markets. Using USDe as collateral helps capital efficiency and provides a funding rate boost on ByBit.

Under weak or negative funding rate environments Neutrl is able to actively switch its liquid composition into the highest liquid yield across the entire funding rate environment or liquid stables. Over the past 3 months, Neutrl has run liquid basis across multiple tokens, including XRP, Hype, BNB, Pepe, Link, TRX, TON and cross CEX arbitrage. Neutrl is not reliant on any single asset. Furthermore, using USDe as collateral on ByBit allows Neutrl to earn USDe as the base yield and build on top.

Overall even with 80% of the portfolio liquid, funding rate capture still makes up a smaller percentage of Neutrl’s yield as shown above. OTC arbitrage strategies provide a significant margin of safety during prolonged weak or negative funding periods, enabling Neutrl to sustain yield and outperform competitors in down markets.

Join our Discord. We will be opening to the public soon.

gNeutrl.