Neutrl’s Approach to OTC Risk

This article outlines how Neutrl manages OTC risk through strict verification, institutional partnerships, and secure settlement practices.

Neutrl is a market-neutral synthetic dollar that brings institutional-grade yield strategies onchain by unlocking private altcoin markets. One of Neutrl’s core strategies involves participating in over-the-counter (OTC) token deals, where discounted assets are acquired and systematically hedged to capture asymmetric yield opportunities. These strategies are designed to generate returns that are not dependent on general market direction, providing differentiated performance in both bull and bear markets.

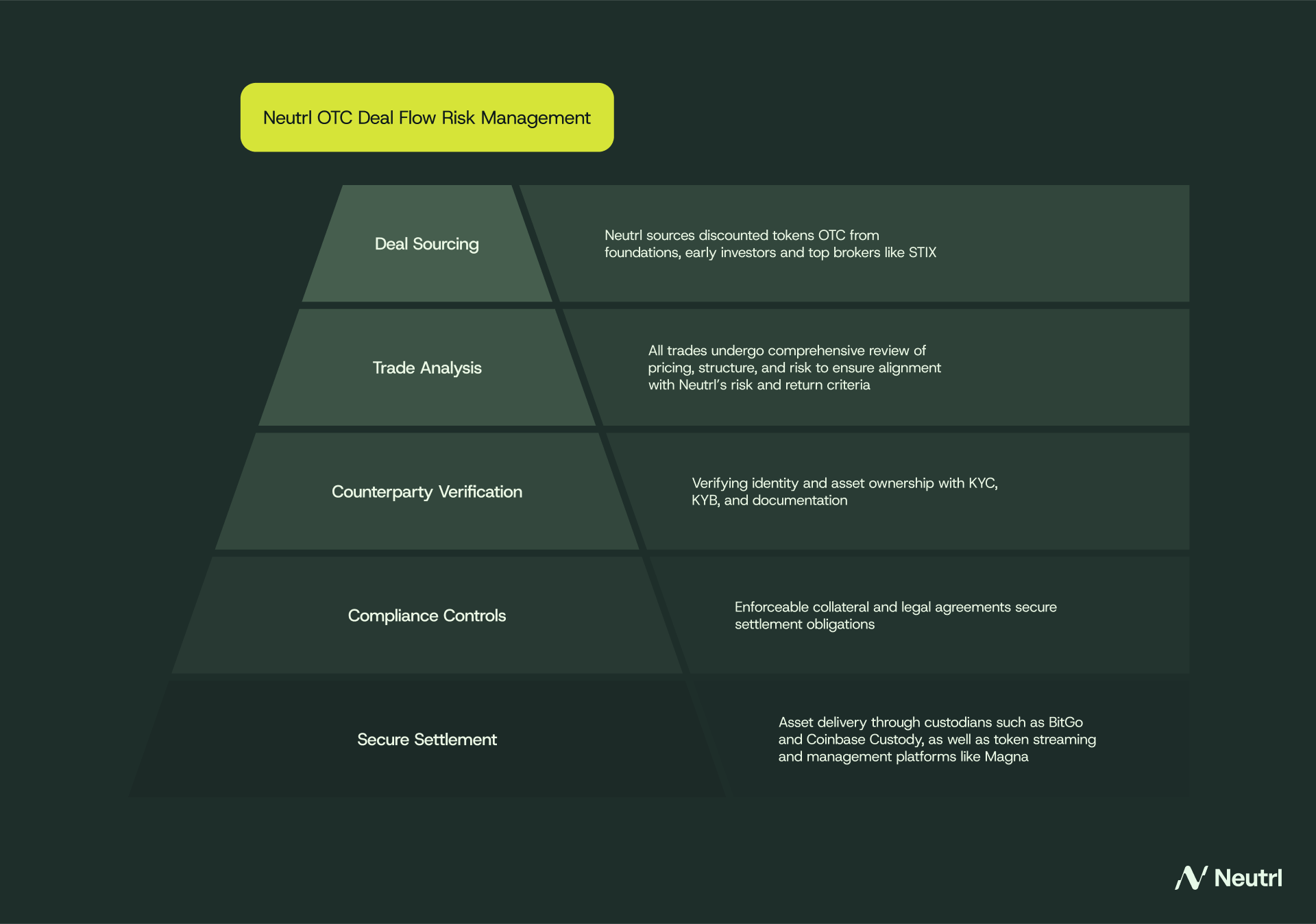

OTC dealflow carries specific risks, especially around settlement and counterparty trust. If deals are not properly structured, participants may be left with undelivered assets or unresolved obligations. Neutrl reduces this risk by using a rigorous verification process, partnering with trusted institutions, and ensuring secure, controlled settlement.

Many OTC transactions in crypto are still conducted informally in private groups, where oversight is minimal and protections are limited. This lack of structure has led to repeated deal failures, including a recent case where more than $50 million was lost in OTC transactions arranged through Telegram chats that were never fulfilled.

Neutrl addresses these risks through a dedicated counterparty risk framework and by partnering with STIX, crypto’s leading institutional OTC trading platform. This partnership ensures that all deal flow comes from trusted sources. Every transaction is subject to strict KYC and KYB checks, asset ownership verification, and secure settlement through custodians, token management platforms, or smart contracts. Neutrl also requires counterparties to sign enforceable legal agreements, providing a clear path for recourse in the event of non-delivery. When appropriate, Neutrl may require collateral from counterparties to further reduce settlement risk. These processes allow Neutrl to safely access OTC opportunities while maintaining strict controls over counterparty and delivery risk.

Before executing any OTC transaction, Neutrl follows a strict verification process focused on security and compliance. All counterparties complete rigorous Know Your Customer (KYC) and Know Your Business (KYB) checks to confirm their legal identity. They must also provide documented proof of ownership for the specific assets involved, such as SAFTs, token warrants, or other agreements that represent rights to locked token allocations.

This verification process supports accurate transaction settlement and is a key component of Neutrl’s counterparty risk management framework.

Neutrl ensures secure settlement by using institutional-grade infrastructure for all asset transfers. Tokens are never delivered directly by individuals or counterparties. Instead, transfers are facilitated through trusted custodians and token management platforms that specialize in secure asset handling. Depending on the terms of the deal, this process may involve custodians such as BitGo or Coinbase Custody, as well as token streaming and management platforms like Magna. In some cases, smart contracts are used to automate the delivery process, providing an additional layer of settlement assurance.

By structuring transfers this way, Neutrl reduces settlement risk and ensures that counterparties meet their delivery obligations in a controlled and transparent environment.

Neutrl is committed to transparency, security, and maintaining high operational standards. The protocol follows strict guidelines for deal sourcing, verification, and settlement to minimize risk at every stage of the process. This includes working exclusively with vetted counterparties, using institutional custodians for token delivery, and maintaining collateral reserves to safeguard capital. Neutrl also regularly monitors exposures and maintains comprehensive reporting to ensure all activities align with its risk framework.

For a detailed overview of Neutrl’s risk management, visit our documentation here.

gNeutrl.