Neutrl Public Launch & Points Guide

Neutrl was created to redefine how yield is generated in crypto. By unlocking access to institutional-grade OTC opportunities and proprietary orderflow, Neutrl delivers a level of market-neutral strategies that has historically been reserved for insiders and institutions. The protocol’s vision is simple: to offer the highest source of crypto-native yield in the industry and make it accessible to everyone.

Following the completion of our $75M Pre-Deposit Vault campaign, demand for Neutrl’s approach has been clear. On November 10, the protocol will open to the public, giving all participants the ability to access these strategies directly through Neutrl’s synthetic dollar. This article outlines what to expect at launch, how the protocol works, and how participants can begin earning Neutrl Points through the Origin Program.

The rapid filling of Neutrl’s pre-deposit vaults was a clear signal of demand for scalable, differentiated yield built on real trading activity. Neutrl’s strategy combines OTC arbitrage, liquid basis, and staked collateral to generate asymmetric opportunities without taking on directional risk.

At its core, Neutrl acquires discounted private-market opportunities and maintains delta-neutrality through systematic hedging across spot and derivatives markets. This approach locks in yield at the source while also earning funding premiums as part of the hedge. Over time, as these OTC positions vest and profits are realized, Neutrl’s realized APR compounds alongside its liquid portfolio, which continues to generate returns in all market conditions.

The public launch marks the first time these strategies will be accessible to all users through NUSD, Neutrl’s high-performance synthetic dollar, and its yield-bearing staked counterpart, sNUSD.

Neutrl’s architecture is built to generate market-neutral yield through a balanced portfolio designed to preserve stability for NUSD holders while maximizing returns for sNUSD stakers. Users can deposit USDC, USDT, or USDe to mint NUSD, which can then be staked for sNUSD to earn yield from Neutrl’s trading and hedging strategies. Locking NUSD and sNUSD for fixed durations provides additional rewards via Neutrl Points. The protocol’s portfolio is strategically allocated across three categories that together balance liquidity, yield generation, and risk management.

Liquid Reserves: A portion of the portfolio is held in stablecoins and yield-bearing instruments such as USDC, USDT, and USDe. These reserves provide immediate liquidity for NUSD redemptions and support the base yield distributed to sNUSD.

Hedged OTC Positions: Neutrl acquires discounted assets through OTC transactions and fully hedges exposure to eliminate price risk. These positions provide a steady source of realized yield as tokens vest and profits are captured.

Liquid Delta-Neutral Strategies: The protocol also runs delta-neutral positions, including perpetual funding arbitrage and basis trading, to generate consistent returns from derivatives market inefficiencies without directional exposure.

Together, these components form Neutrl’s yield engine, an actively managed portfolio that compounds realized returns over time while maintaining liquidity and market neutrality.

Earning Neutrl Points is about participation and alignment. Neutrl Points represent a measure of early contribution and commitment to Neutrl’s mission of making institutional-grade yield accessible to all users. Participants can earn Neutrl Points by holding NUSD, staking NUSD to receive sNUSD, committing NUSD and/or sNUSD for fixed locked durations, providing liquidity, and supplying collateral approved DeFi venues. Timing and commitment are key, as an example, the longer users lock their NUSD or sNUSD, the greater the multiplier on their Neutrl Points. These boosts are designed to reward early adopters who align with Neutrl’s long-term vision and remain committed over time.

Beyond staking, participants who collateralize or provide liquidity for NUSD and sNUSD across whitelisted DeFi venues play a critical role in expanding the Neutrl ecosystem. By supplying NUSD or sNUSD to approved venues and maintaining those positions, users help build lasting TVL that deepens liquidity and tighten spreads. By locking, providing liquidity, or collateralizing these assets in lending markets, participants not only enhance their yield but also strengthen the long-term health of the protocol. The Origin Program’s structure is designed to ensure that the highest rewards go to those who contribute meaningfully to Neutrl’s foundation of stable, market-neutral yield and sustained protocol growth.

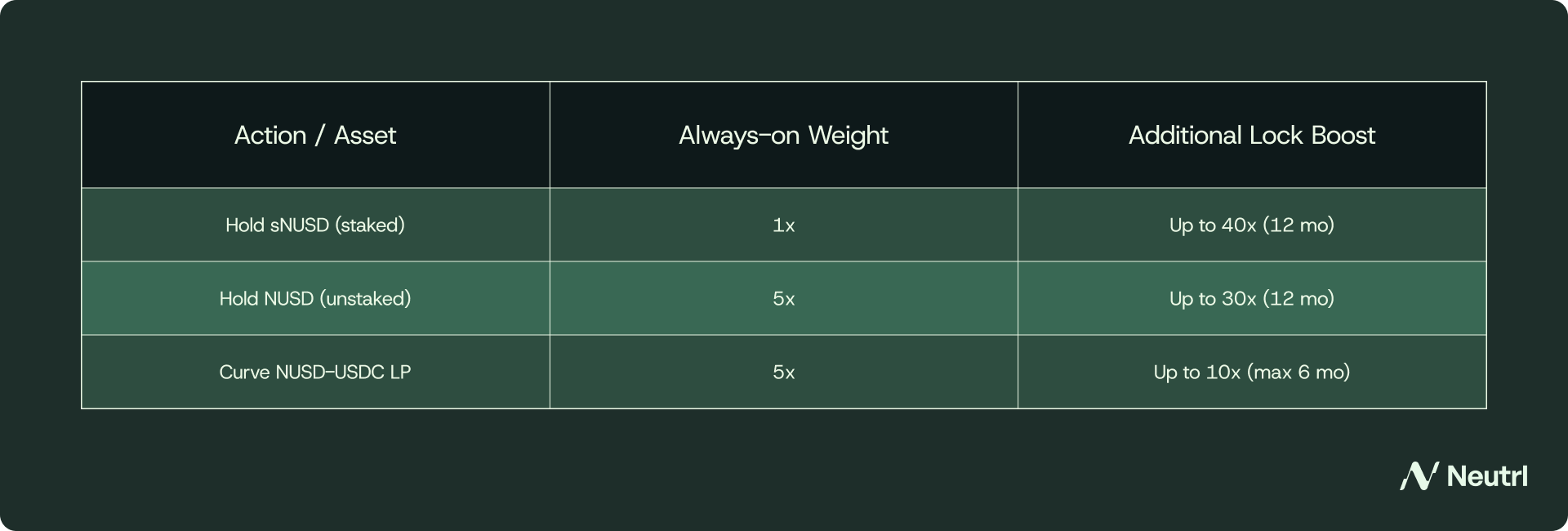

Neutrl’s incentive system is designed to reward users based on both participation and commitment across the protocol. Each position generates Neutrl Points through an always-on multiplier, which determines the base rate of accumulation, and an optional lock boost, which increases rewards for users who commit assets for a fixed period. The longer the lock duration, the higher the potential boost.

At launch, incentives will apply to core integrations including NUSD, sNUSD, and Curve LP positions. Additional venues for earning Points will be introduced progressively, each with reward mechanics tailored to its respective integration.

Note: The incentive schedule may be updated over the course of the program. Additional venues for earning Neutrl Points may be introduced.

Participants in the Neutrl K3 Capital Pre-Deposit Vault already hold a key position in the protocol’s early growth. Vault depositors who hold preNUSD have begun to accrue Neutrl Points at a rate of five points per preNUSD per day, giving participants early exposure to the program ahead of the public launch. Once the protocol is live and depositors receive their upNUSD airdrop, Neutrl Points will accrue based exclusively on vault activity managed by K3 Capital. The vault is designed to maximize exposure to Neutrl Points without requiring any active management from depositors.

During the pre-deposit phase, participants locked their deposits for 2.5 months to secure access to yield and ecosystem rewards, including XPL and Upshift Points. Upon contributing to the vault, users received preNUSD representing their deposit. When the protocol launches, they will be airdropped upNUSD, which reflects their proportional share of the vault. upNUSD accrues value throughout the 2.5-month lock period and can be redeemed for NUSD once the period ends.

All pre-deposit participants will automatically earn Neutrl Points based on their vault activity, with no additional action required. Once the lockup period ends, depositors can exchange their upNUSD for NUSD and begin staking through the protocol to continue compounding rewards.

Ecosystem incentives such as XPL and Upshift Points accrue separately from Neutrl Points. Participants in the pre-deposit vault can claim their accrued XPL rewards directly from Merkle here.

Neutrl’s public launch marks a defining moment for market-neutral yield in crypto. By combining proprietary orderflow with institutional-grade execution, Neutrl unlocks one of the industry’s most durable and overlooked sources of return: OTC arbitrage. These asymmetric opportunities, once reserved for funds and insiders, will soon be accessible to all users through Neutrl’s synthetic dollar designed to deliver the highest source of crypto-native yield.

The launch also introduces the Neutrl Origin Program, which rewards early contributors helping to establish this new primitive. Built around differentiated yield powered by real trading activity rather than speculative mechanics or token emissions, Neutrl sets a new benchmark for how institutional strategies are accessed and scaled across decentralized finance.

The public launch begins November 10.

Learn more at neutrl.fi and follow us on X for updates.

gNeutrl.

This document is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation of any securities, tokens, or other financial instruments. Nothing contained herein should be construed as financial, legal, tax, or investment advice. You should not rely on this document to make any investment decisions. Participation in the Neutrl protocol and related strategies involves significant risks, including but not limited to loss of principal, volatility of digital assets, market, counterparty, operational, smart-contract, and regulatory risks. Past performance, projections, or simulated returns are not indicative of future results. No assurance is given that any objectives or forecasts will be achieved.

Neutrl and its affiliates make no representation or warranty, express or implied, as to the accuracy, completeness, or reliability of the information contained in this document, and expressly disclaim to the fullest extent permitted by law, any liability for any direct, indirect, incidental, or consequential losses arising from use of, or reliance upon, the protocol or its documentation. Any user or participant is solely responsible for conducting their own independent due diligence and obtaining professional advice before engaging with the protocol.

Use of the Neutrl protocol may be subject to restrictions under applicable laws, regulations, or the rules of relevant jurisdictions. It is the responsibility of each individual to ensure compliance with all applicable requirements before interacting with the protocol in any manner.

Neutrl is not registered, licensed, or regulated as a financial institution, investment adviser, broker-dealer, or payment service provider in any jurisdiction. The Neutrl protocol operates as an autonomous, decentralized software system and is not affiliated with or endorsed by any regulatory authority.

NUSD and sNUSD are synthetic digital representations designed for use within decentralized finance. They are not fiat-backed stablecoins, bank deposits, securities, or investment products, and are not insured or guaranteed by any government or deposit protection scheme.

All references to “yield,” “returns,” or “APR” are illustrative only and may vary materially based on market conditions. No representation or guarantee is made regarding the continuity, level, or source of any yield.

Certain information contained herein may include forward-looking statements that are subject to known and unknown risks and uncertainties. Actual results may differ materially from those expressed or implied.