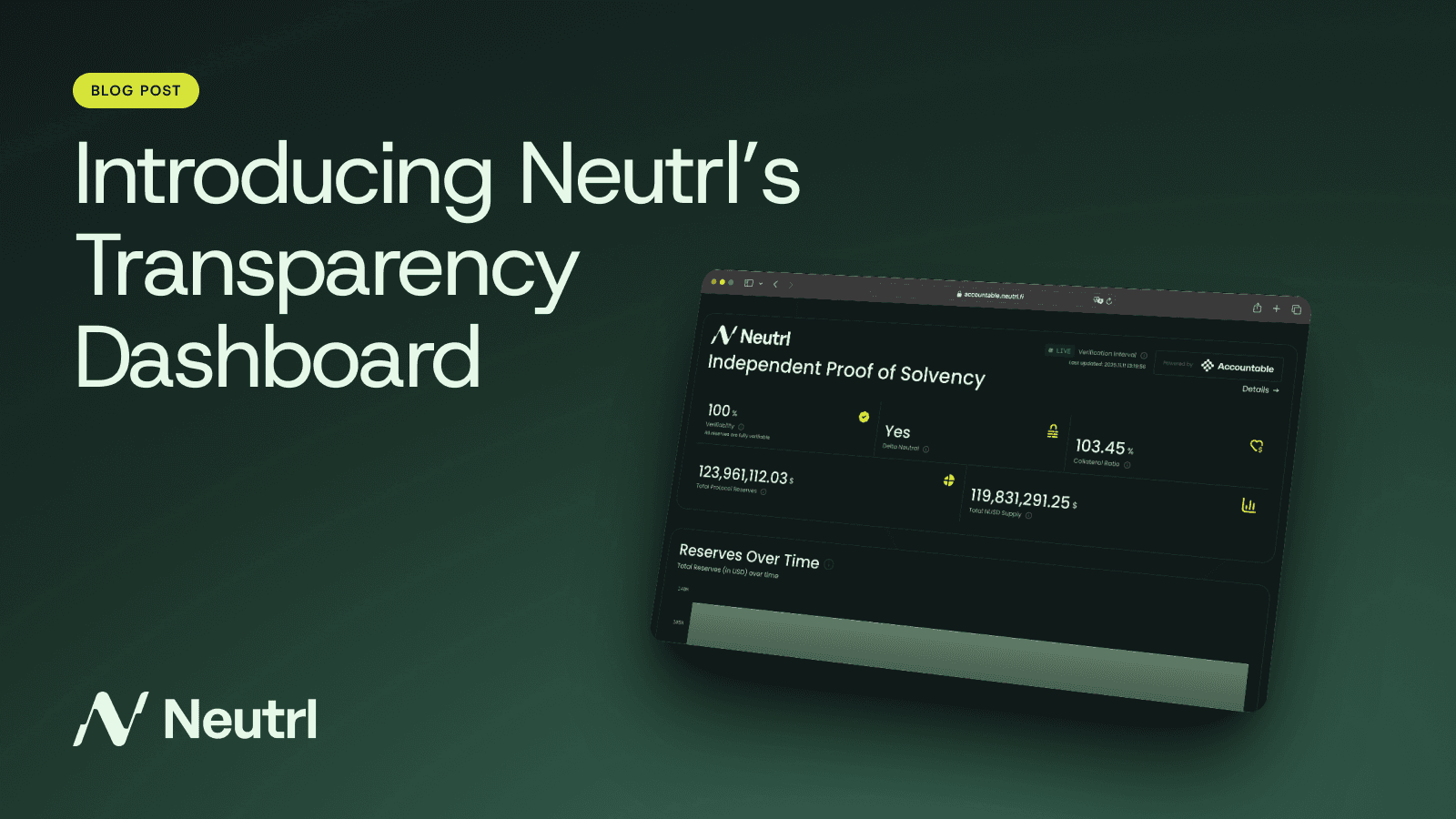

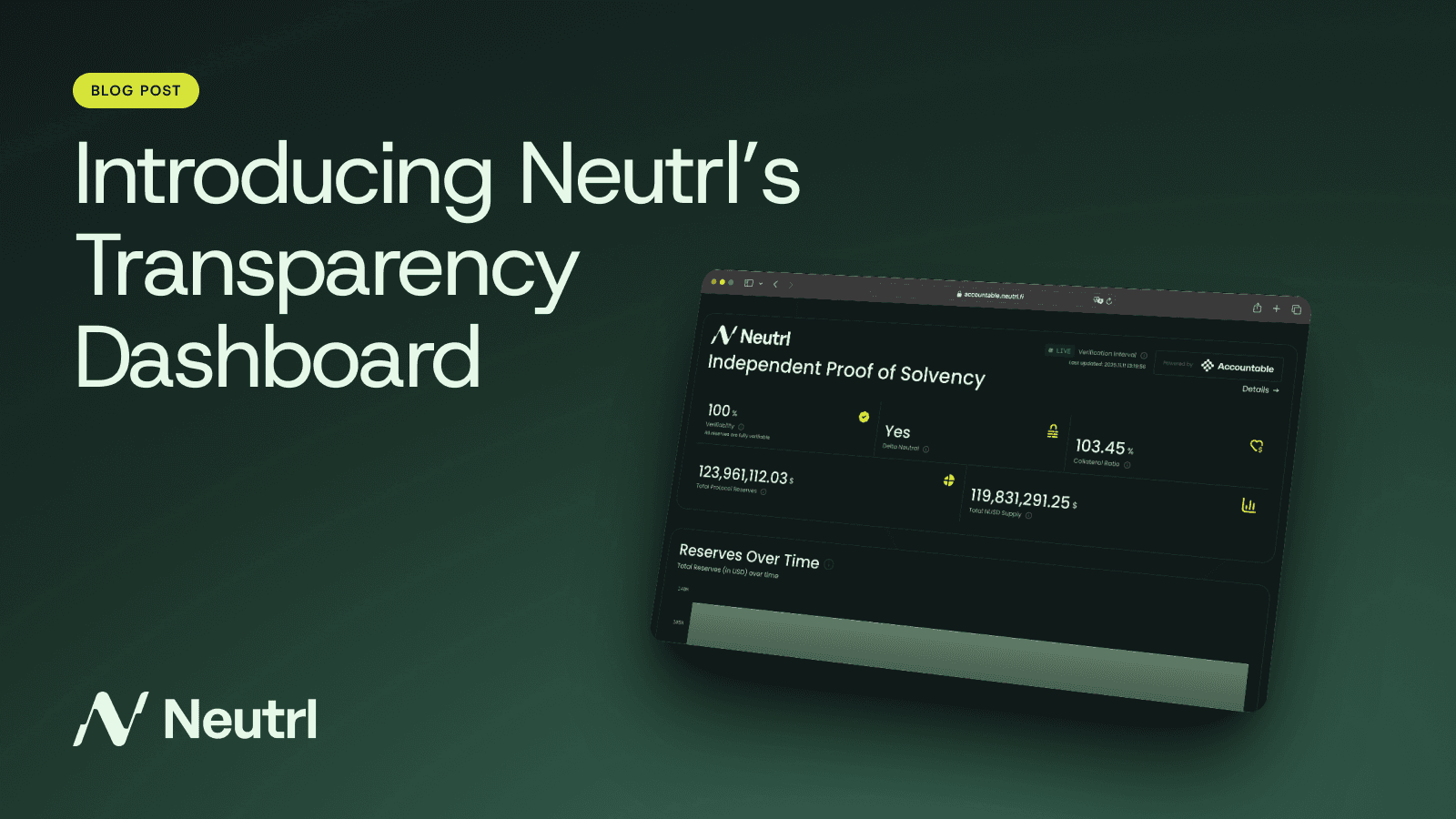

Introducing Neutrl's Transparency Dashboard

Neutrl, in collaboration with Accountable, has launched an independent Proof of Solvency Dashboard designed to provide verifiable transparency into the protocol’s reserves, exposures, and financial health. This dashboard enables third parties to confirm that Neutrl’s synthetic dollar, NUSD, and its staked counterpart, sNUSD, are fully collateralized at all times by verifiable assets.

The system functions as an open reference for users, partners, and researchers to assess Neutrl’s collateralization ratio, asset composition, delta neutrality, and allocation of reserves across both onchain and offchain venues. It also shows how the protocol’s reserves are distributed between yield strategies and portfolio composition.

To guarantee verifiability, the dashboard employs Merkle Sum Trees, Secure Enclaves, and Zero-Knowledge Proofs, creating a cryptographically verifiable and tamper-proof record of the Neutrl protocol’s financial state in real time.

Accountable provides the independent verification infrastructure that powers Neutrl’s real-time Proof of Solvency framework. Accountable is the leading provider of on-chain financial verification, currently verifying over one billion dollars in assets for top institutions and asset management firms. The platform enables verifiable, privacy-preserving proof of solvency without exposing sensitive operational data. Each proof is generated through a Merkle Sum Tree, which produces a cryptographic root hash representing the complete dataset of verified assets and liabilities. Any alteration to the underlying data invalidates the proof, ensuring absolute data integrity. Secure Enclaves provide a controlled and isolated execution environment where verification operations are securely performed. Zero-Knowledge Proofs allow for public verification of solvency and asset coverage without revealing detailed sensitive data or proprietary trading data.

Through this institutional-grade verification architecture, Neutrl’s transparency dashboard delivers cryptographically sound Proof of Solvency and accurate reserve reporting, providing users and partners with real time insights into the protocol’s health.

The transparency dashboard provides a real-time, verifiable view of Neutrl’s total reserves and liabilities, allowing anyone to confirm that every NUSD in circulation is fully collateralized at all times.

Displayed metrics on the Transparency Dashboard include the total supply of NUSD, representing the aggregate amount of tokens minted, and the collateralization ratio, which compares verified reserves to circulating supply to confirm that NUSD remains overcollateralized. The dashboard also reports verifiability, indicating the percentage of assets independently verified from custodians and smart contracts, and delta neutrality, which measures whether Neutrl’s overall position remains market-neutral. Finally, it displays total protocol reserves, representing the complete sum of verified assets across all data sources.

To protect the integrity of active positions and the protocol, individual OTC positions are not disclosed. However, the aggregate allocation to this strategy is transparently reported through the dashboard to maintain full visibility at all times.Currently, OTC arbitrage accounts for roughly ten percent of total reserves, with the remainder distributed across funding rate arbitrage strategies and liquid stablecoin holdings.

Over time, the dashboard will continue to evolve with additional verification layers, including independent third-party audits, custody attestations, reserve fund disclosures, and granular breakdowns of protocol exposure.

Neutrl’s yield is derived from a structured and fully collateralized blend of OTC arbitrage and delta-neutral trading strategies, supported by a strong base of liquid reserves. Each allocation is designed to generate sustainable yield while maintaining solvency and risk control.

The protocol’s OTC arbitrage strategy acquires discounted private-market assets through direct transactions and fully hedges all market exposure. These positions deliver predictable yield as the underlying tokens vest and profits are realized. OTC transactions currently account for approximately ten percent of total reserves and form the foundation of Neutrl’s yield engine.

The remaining reserves are held in liquid stable assets including USDC, USDT, USDS, and USDe. These assets ensure that Neutrl maintains redemption liquidity and operational flexibility at all times.

Neutrl’s transparency dashboard establishes a new benchmark for verifiable solvency and financial reporting for yield-bearing synthetic dollars. Through cryptographic proofs, independent verification, and continuous updates, users and partners can independently verify that every NUSD is fully collateralized at all times.

As the transparency dashboard continues to evolve, Neutrl will introduce additional transparency measures including third-party reserve audits, insurance attestations, and automated exposure reporting. These enhancements are designed to reinforce accountability and provide full assurance that all yield is generated through disciplined risk management and rigorous accounting standards.

See Neutrl’s transparency dashboard here. Follow us on X for more updates.